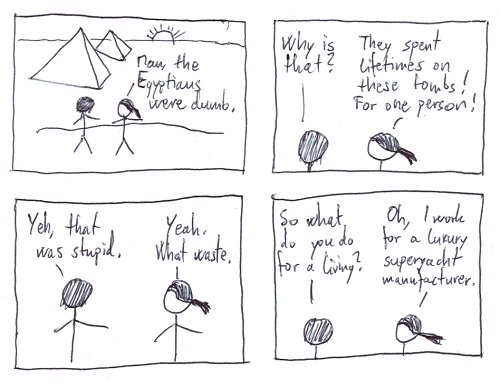

A superyacht is absolutely no better than an Egyptian tomb. It is to build a huge and expensive thing for one person (and their close friends), instead of spending the time and resources building something more widely useful. To think this is better than a pyramid is to fool ourselves with economic sophistry. Anyone who looks at this from a 1,000 year perspective will consider us foolish.

To say that superyachts and private jets are "good for the economy" is equivalent to the Broken window fallacy. Superyachts, jets, and villas that no one lives in, are extremely expensive broken windows.

Progressive consumption tax

I do not suggest defining some arbitrary categories of products as "luxury goods", and taxing them out of existence. We shouldn't be in the business of defining what is luxury and what isn't.Instead, I suggest a progressive personal consumption tax, where all personal spending is taxed at 0% for the first X$ per year until some threshold, then 5%, then 10%, and so on. Optimally, a smooth formula should be used such that the tax percentage just keeps growing, indefinitely. The more you spend on personal consumption, the higher the consumption tax you pay.

The tax rate would automatically raise to some level resembling 900% if your annual personal consumption is in the hundreds of millions. It doesn't matter what you spend it on – one superyacht, one hundred supercars, or 1,000 paintings.

This does require spending to be differentiated as to whether it's personal spending, or an investment, or a business expense. However, this does not invent new complexity that is not needed for income tax administration already.

But what of the lost jobs?

When you impose a tax on luxury goods that causes some jobs to go away, of course that produces tangible, noticeable pain when workers producing those goods are no longer needed. When the economy restructures to reabsorb those people, this is diffuse, distributed, and subtle. You notice the pain, but not the relief. This may lead a person to think that damage was done by discouraging production of luxuries.But this is not so. Even outside of tax collected, the very fact that pointless things are not being produced is a benefit to the economy. The tax is meant to reduce this type of consumption, which means it will cause job losses in the short term. But longer term, the money will go somewhere else, and jobs lost will be reabsorbed. The real benefit is in the long run (generations), not the short run (next few tax years).

But consumption moves abroad

Unfortunately, it does not do much to progressively tax consumption when people can quite simply board their jets, and take their yachting to another country, without taxation. A consumption tax is subject to tax avoidance even more so than taxation of income. Who hasn't yet taken advantage of state or country borders to benefit from shopping in a city with no sales tax? When it comes to superyachts, jurisdiction shopping is a no-brainer. Of course the yachts are going to be built and used where taxes are minimal.To the extent that consumption can move abroad, any progressive taxation of personal consumption therefore has to be accompanied with measures to discourage avoidance. Most Western economies already tax worldwide income. Perhaps taxation of worldwide spending might not be so inconceivable.

Showing 1 out of 1 comments, oldest first:

Comment on Oct 21, 2015 at 12:12 by Boris Kolar